Optimism abounds within Utah's A/E/C industry for another strong year of economic activity in 2024. By Brad Fullmer

Utah Remains an Economic

Darling Nationally

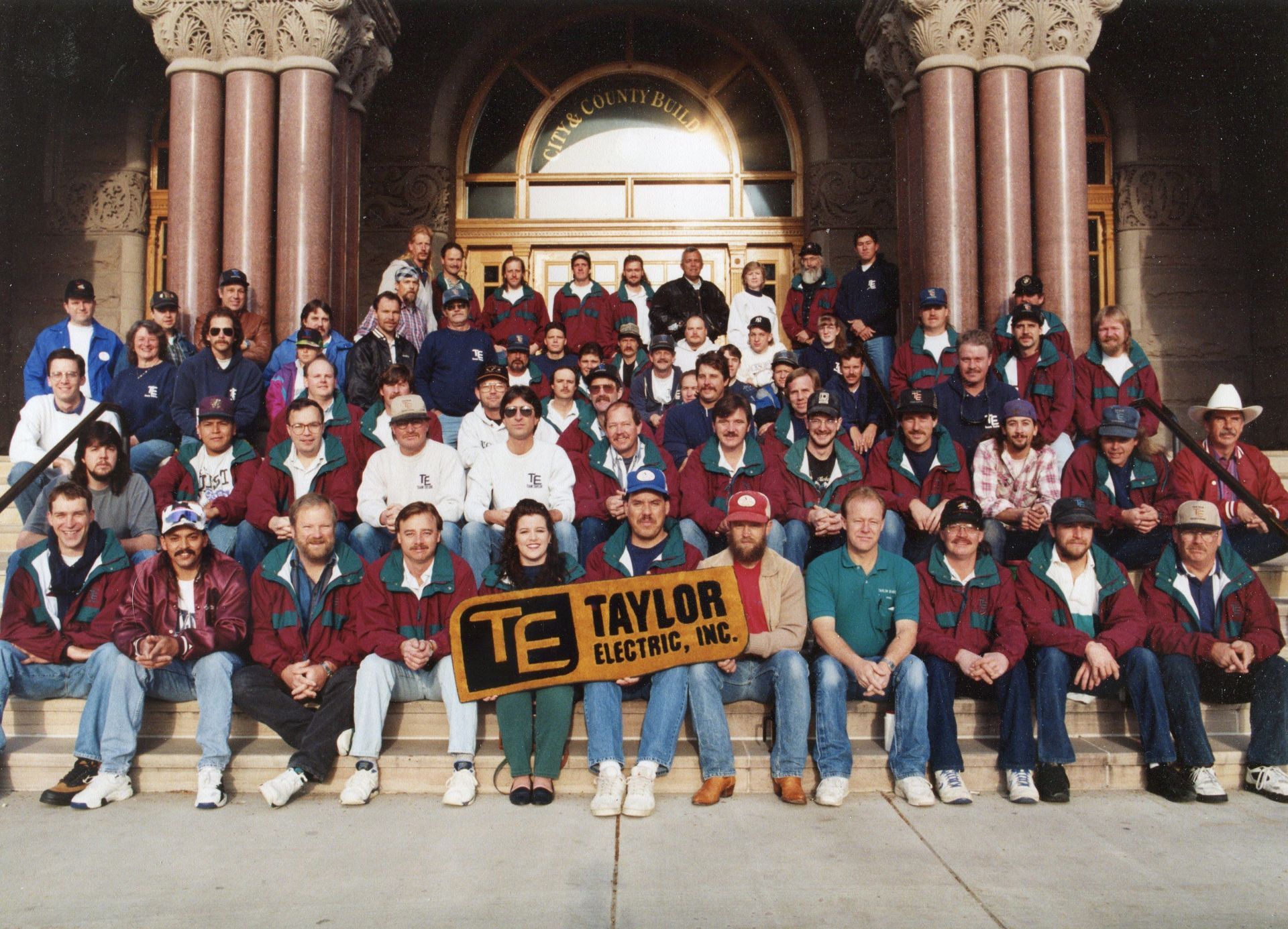

Ever since A/E/C firms began crawling out of the "great recession" more than a dozen years ago, Utah has received more than its share of love on a national level regarding its overall economy, and construction is viewed as one of the most critical economic drivers.

In January, the Santa Monica, Calif.-based Milken Institute (milkeninstitute.org) released its 2024 Best Performing Cities rankings. Among large metropolitan cities, Salt Lake City impressively climbed from 19th to 4th overall, Provo-Orem slipped four spots from 1st to 5th, while Ogden-Clearfield dropped eight spots to 26th. Among small cities, Utah placed two in the Top 15: St. George was 4th (down one spot), while Logan was 15th (down from 2nd).

In September, Rich States, Poor States: ALEC-Laffer State Economic Competitiveness (richstatespoorstates.org) ranked Utah No. 1 for Economic Outlook and No. 2 for Economic Performance in April 2023.

Last May, Utah once again placed No. 1 overall on the Best States rankings from U.S. News & World Report, which ranks all 50 U.S. states in 71 metrics across eight categories. The data behind the rankings aims to show how well states serve their residents in a variety of ways.

Each of the eight categories was assigned a weight based on the average of three years of data from recent national surveys that asked nearly 70,000 people to prioritize each subject in their state. The categories in the Best States framework, along with their weights, includes: Healthcare (15.97%); Education (15.94%); Economy (13.36%); Infrastructure (12.93%); Opportunity (12.29%); Fiscal Stability (11.36%), Crime & Corrections (9.16%); Natural Environment (8.99%).

The Beehive State topped two of the eight categories: Economy and Fiscal Stability—a combined 25% of the weight, which explains why it's No. 1 overall (followed by Washington, Idaho, Nebraska, and Minnesota in the Top 5). Utah ranked first and second, respectively, in the employment and growth subcategories under Economy.

Utah also ranked strong in Infrastructure (4th), Education (5th), and Health Care (7th), with the latter two being the top two weighted metrics (nearly 32% combined). Utah's infrastructure is considered solid, with a robust transportation system that benefits from strong leadership within the Utah Department of Transportation (UDOT), water districts that are strategically planning and investing in new water projects, and a state legislature willing to spend money to keep pace with Utah's surging population growth.

The three categories Utah placed outside the Top 10 included Crime & Corrections (a respectable 15th), Opportunity (a solid-if-not-spectacular 20th), and Natural Environment, the lone black mark on the scorecard at 46th—fifth-worst nationally—which factors in air and water quality, along with pollution. Indeed, Utah's notoriously poor air quality in recent years remains a thorn in overall quality of life for its residents, with heightened concerns from scientists and conservationists over the shrinking Great Salt Lake (GSL) and the potential for even worse air quality if the lakebed runs dry.

Utah legislators say they are committed to saving the Great Salt Lake, but finding adequate water sources to funnel into a body of water that spans over one million acres is going to be easier said than done.

If anything, saving GSL could be a boon for local heavy-civil contractors in the form of new projects that improve waterways and increase the number of pipelines running to the lake. The Utah State Legislature passed a 2022 bill allocating $40 million to the Great Salt Lake Watershed Enhancement Trust, which as of last October had spent $1.3 million and secured 64,000-acre feet, some of which was donated to the cause.

Multi-Family, Industrial Markets Still Active; Office Hard to Gauge

Eskic said building markets such as Multi-Family and Industrial—two of Utah's top markets for more than a decade running—are poised to still see significant activity. In the Multi-Family arena, the state needs to build 28,000 units annually, according to legislative auditors, to keep up with demand, which is projected to grow to 37,000 units by the end of 2024, according to November stats from the Gardner Institute.

Governor Spencer Cox believes a push needs to be made to build 35,000 new single-family "starter homes" in the next five years in addition to whatever multi-family projects get built, an ambitious, if not totally feasible, proposal.

Gilbert concurs that more starter-type homes are needed as it provides the basis for people's long-time future security.

"We still have an affordable housing issue, and the Governor's push to get back to building more single-family homes—1,300 square foot homes—is something for people to build income and wealth and sustain them through retirement. You're not going to get that from renting an apartment."

Eskic said vacancy rates are expected to climb once the influx of downtown apartments—he estimates 4,000 new units in the greater downtown area—comes online in the next 12-18 months, including upscale projects like Astra Tower and Worthington Tower.

"Overall the multi-family market is fine in Utah because our excess is concentrated in pockets, like downtown," said Eskic. "What worries me is that some proposed new projects are on pause and there is nothing new in the pipeline until 2026 or early 2027, which puts us back to a 2019 market where it will be tight, and demand will catch up."

The industrial market, Eskic speculated, "won't get the same expansion of new projects because of financing, but overall, the U.S. demand for industrial will continue to ride out the decade," with expected demand driven by high-tech firms (think data centers), e-commerce and retail distribution giants (Amazon, Wal-Mart, etc.), and logistics.

Eskic pointed to the recent announcement of Texas Instruments investing $11 billion in its Lehi manufacturing plant operations over the next decade as one megaproject that will have a positive trickle-down effect on the market. "My outlook for industrial is cautiously positive," he said.

Commercial office is one market that is hard to predict, Eskic said, given that "30% of the [traditional office] workforce works remote—that has not budged in the past 18 months. Office is transforming—how [employers] use space is different. What you'll see in office is an increase in vacancy and also a decrease in value, albeit [Utah's] office market is not as vulnerable as other metro cities."

Eskic said three interest rates cuts are expected this year from the Fed, up to 1.5%, which should stem some of the concerns coming from the private development sector. "The consensus is by the end of this year we'll settle into the mid-to-low 6% range [on mortgages]," said Eskic. "We're not going to feel the benefit of these cuts as much, but we need to manage the expectation that we might not see a dramatic drop in interest rates. The Fed is trying to keep inflation managed and unemployment steady."

US News & World Report 2023 Best States Rankings

(from May '23)

1. Utah

2. Washington

3. Idaho

4. Nebraska

5. Minnesota

Utah's Scorecard Rankings

Crime & Corrections #15

Economy #1

Education #5

Fiscal Stability #1

Health Care #7

Infrastructure #4

Natural Environment #46

Opportunity #20