Operation Gigawatt is a year in the making, but how will Utah’s power sector respond for calls to double the state’s power production by 2034? By Taylor Larsen

The natural gas-fired turbines pictured here will be critical in delivering both “in-situ” and grid-ready power required by Operation Gigawatt.

Managing Regulatory Challenges

In response to these and other challenges, full service experts are emerging.

Thompson said Big-D Companies created Big-D Power Solutions in late 2024, a turn-key solution for energy-intensive projects. They align a consortium of developers, financiers, and energy experts to develop the project, finance the on-site power development required, and then build the infrastructure.

Price-based Castle Gate Engineering follows a similar, full-service business model, backing up its efforts by maintaining the energy systems it develops. Business is good in this arena, but it could be much better through regulatory changes.

“Before you begin any project that can connect to the grid,” began Brok Thayn, Chief Executive Officer of Castle Gate Engineering, “there must be a study to see that the grid can handle either the generation or the load.”

For those looking to use power from utilities such as Utah Associated Municipal Power, Utah Municipal Power Agency, Deseret Power, and Rocky Mountain Power, the answer seems to be "wait and see."

“We've had projects sitting in the queue for up to eight years,” said Thayn. “You lose a lot of projects and a lot of capital when you can't get a project through.”

The regulatory environment is improving. S.B. 132 Electric Utility Amendments, which, among other provisions, established alternative processes for large-scale power users (100 megawatts or more within five years) to obtain power outside of the utility, should the utility not be able to meet that demand without significant investments.

Thayn reported that certain utilities have also changed their approach by shifting from “first-come, first-served” to “first ready”, prioritizing interconnection requests from those with financial commitments and site control to generate the power required. Under the new rules and regulations, a current Castle Gate Engineering project, one under study for three years and projected to complete by 2032, is set to be completed by 2027.

Is it that bad?

“The [power] supply is so low and the demand is so high,” Thayn explained, that power quality is growing more critical to their clients. He explained that wildfires and the subsequent power restrictions imposed by utilities during disasters make brownouts more likely than ever before. It seems Californians aren’t the only thing migrating to Utah—power issues are migrating this way, too.

“I think that [Utah electric utilities] have done a good job of trying to let customers have choice,” said Thayn, specifically crediting the utilities for their work to bring about more renewable power and filtering through a massive amount of projects. Those efforts are complicated as utilities are required to maintain rates and would rather have the developer take the risk in bringing additional power to the grid.

The Nexus of Capital, Expertise, and Procurement

Legislation and policy continue to evolve, but traditional capital will remain sidelined until the sector stabilizes. Even if capital is willing to invest, the relative novelty of power development creates hesitancy as the project moves ahead.

“It’s not that these power developments are overly complicated,” said Renee Swinburne, Chief Business Officer for Castle Gate Engineering, “but power systems are different than traditional building developments, and power systems require monitoring and care to ensure they’re working at optimal levels.”

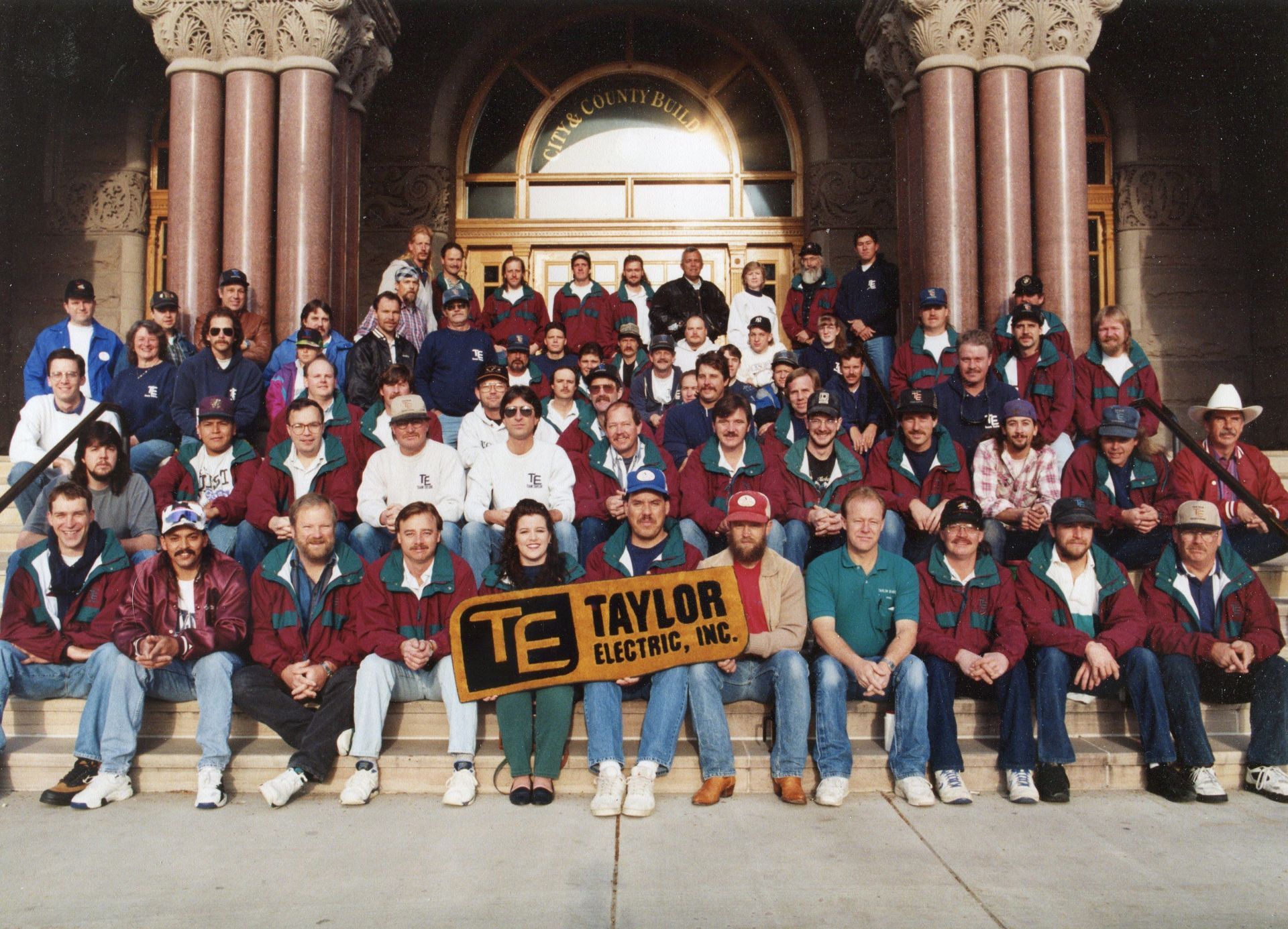

But the people capable of building and maintaining such systems are, much like Utah’s available electrical power, dwindling.

"We're lacking in that area," said Bryce Fowles of the shrinking pool of power experts at every level—engineers, electricians, linemen—capable of helping Utah complete Operation Gigawatt. Fowles, Castle Gate Engineering's Chief Operations Officer, said the industry is playing catch-up after decades of investment and education in electrical engineering shifted to the microchip and data processing sector, away from power generation.

It's getting better; the Utah Legislature approved higher education funding for energy-related programs, some of which are coming to Utah State.

“Schooling helps,” Fowles concluded, “but there is a bigger lack of experience, and if we don’t remedy that, we’re going to lose quite a bit of momentum.”

The job market can (hopefully) remedy the dearth of expertise. Regulatory timelines, on the other hand, need a surge of political support, especially if developers are willing to sign off on millions of dollars’ worth of large, specialized products that require at least 12 months of lead time.

Green and the Joule project team received the go-ahead to purchase generator sets, controls and switch gears, emission control systems, battery energy storage, absorption chillers, cogeneration equipment, logic controls, and more—mostly from US-based manufacturers. Joule and their partners aren’t the only ones willing to sign off on approved power generation projects.

“We’ve heard from so many firms that want to deploy capital to the energy sector,” said Haslem.

“Developers are wanting to get in and stack capital.”

The Future of “All of the Above” Energy

As more energy-intensive projects seek the Beehive State, Thompson said the “all-of-the-above” approach to power development is bearing fruit, with new sources coming online. He spoke about future biofuel production coming to Fairfield, capturing methane at the Intermountain Regional Landfill and turning it into electricity.

The sun still shines on solar, with Haslem saying the Intermountain West remains a prime spot for solar development. He has also been seeing significant growth in engine-driven power from natural gas-fired turbines —especially to meet the enormous power needs of data centers.

For Castle Gate Engineering, many of their clients have corporate goals to consume environmentally conscious power, lower overall energy costs, or keep their facilities fully powered during power drops. Swinburne said they mirror the state’s “all of the above approach”: developing solar and other on-site power generation; assisting traditional power plants with innovative automation; interconnection, transmission and power analysis solutions; and battery storage.

The sources mentioned previously account for around 98% of Utah's power mix, but not for long.

Across the border in Wyoming, nuclear reactor designer TerraPower broke ground on its first Natrium reactor project in 2024, with plans to deliver 345 megawatts at base output, and storage technology can boost the system's output to 500 megawatts to meet peak demand.

Back in the beehive, TerraPower signed an agreement with developers at Flagship Companies and the Utah Office of Energy Development to jointly identify and assess Utah sites for a potential advanced nuclear plant. Preliminary site recommendations should arrive by year’s end.

Operation Gigawatt and federal support are welcome to help geothermal energy production utilize the estimated 10 gigawatts of untapped capacity in Utah. The Department of Energy gave the Frontier Observatory for Research in Geothermal Energy (Utah FORGE) a $218 million research grant and $80 million in additional funding for the observatory to develop, test, and optimize the methods and techniques required to develop enhanced geothermal systems (EGS) resources and make geothermal energy possible anywhere.

The Journal of Petroleum Technology reported two breakthroughs in 2024. Utah FORGE injected water from one hydraulically fractured well, where over 90% of the produced water recovered at the production well reached geothermal-ready temperatures around 370°F. The second came from nearby Cape Station, a multiphase EGS run by Houston-based Fervo Energy. Two enhanced geothermal flow tests produced over 10 MW of electricity. Plans call for Cape Station to begin supplying up to 90 MW of grid power by 2026, with 400 MW contracted and set to be supplied by 2028.

Future Outlook

While new technologies emerge, each of these power players and their teammates field calls to build the infrastructure to meet their respective power demands, and, in the process, Operation Gigawatt.

“This is a highly political item right now,” said Thayn. “And instead of making a political statement, legislators need to understand the math and the physics behind how we will double our power.”

If capital, expertise, and innovation combine to double Utah's power production by 2034, state leaders will need to learn and align to create an environment where investment feels safe to enter. With that level of consistency, professionals like those interviewed can work together to develop solar, natural gas, geothermal, and nuclear energy sources—all of the above—to revitalize our grid and ensure Operation Gigawatt is a success that actively meets our future power demands.

Battery storage, like that being installed here, is essential for flexible power generated from sources whose energy production fluctuates, like solar panels and wind turbines.