Beehive State Buoyancy

More than a full year removed from the pandemic, labor remains the number one concern across the board for Utah’s construction and design industry. That said, commercial A/E/C firms remain as busy as ever and express “cautious optimism" at a robust 2023, despite continuing material volatility, rising interest rates, and a shaky housing market. By B. H. Wright

From March 2020 thru the last quarter of 2022, the pandemic altered normal day-to-day operations for businesses across the spectrum, which for A/E/C-related firms resulted in even more strict protocols and procedures designed to ensure healthy worksites.

A year later, it seems like a dream (nightmare at times) as the industry churns forward at a solid pace and with a collective sense of optimism that 2023 will be another profitable year. And forget about troubling economic signs on a national level. Time and time again, Utah has been buoyed by a “secret sauce” of positive factors (top five in economic growth, population growth, young average age) and this year again looks promising.

Local economic prognosticators—including Robert Spendlove, Jim Wood, and Natalie Gochnour—believe Utah’s design and construction industry is poised for another strong year overall, albeit softer than 2022.

“The U.S. is the strongest economy in the world, and Utah continues to be the strongest economy in the nation,” said Robert Spendlove last November at a Utah Ready-Mix Concrete Association meeting. Spendlove, Sr. VP/Chief Economist for Zions Bank and District 49 Representative in the Utah State Legislature and Chair of Revenue and Taxation Committee, continued, “We’ll see business activity and revenues go down, but we’re well-positioned.”

Despite two quarters of negative growth (-1.6% in Q1 and -0.6% in Q2) last year—one of the main indicators of a pending recession—the economy rebounded to post just under 3% growth in November 2022, capping off the year on a high note. Utah remains in the top five nationally in unemployment (2.1% average between the Wasatch Front and statewide), with a 3.7% jump in job growth, and continues to be among the best states for business development, overall economy, and quality of life.

“We’ve been below 3% [unemployment] for a long time—it’s almost like it’s normal,” said Gochnour, Director of the Kem C. Gardner Policy Institute at the University of Utah and Chief Economist for the Salt Lake Chamber. “Since 2000, Utah has annually ranked ahead of the national average [for job growth]. We have an amazing economy, diverse, growing, [and] stronger fundamentals than all states. That’s something we should take heart in. We’re the best state to head into (a recession).”

“Are we going into a recession?” Jim Wood asked as he spoke to attendees of the American Concrete Institute (ACI) of Utah’s Economic Forecast luncheon on January 10. Wood, Ivory-Boyer Senior Fellow at the Kem C. Gardner Policy Institute and a long-time forecaster of non-residential permit authorized construction in Utah, believes the state will have low, steady economic growth.

Of all the groups of business leaders Wood and his team meet with—including the Utah State Legislature and Governor’s Office of Economic Opportunity—the consensus was a 2% growth rate.

“I was more optimistic than that,” said Wood, who predicts that 2024 will see a marginal decline to 1% growth. “We have a very unique situation in terms of employment growth and unemployment rate. That’s why I’m optimistic that we won’t see [significant] job loss.”

Wood mentioned continuing work at the Salt Lake International Airport, a new downtown hospital by Intermountain Healthcare that will anchor 10 acres on the site of the former Sears building, and a still-sizzling multi-family market highlighted by five dazzling downtown high-rise buildings as just a few examples that illustrate his bullish outlook. The multi-family market peaked at 40,000 residential units in 2021 (up 30%) and is predicted to hit 29,000 in 2023, a bit of a market correction.

“In Salt Lake right now there are almost 5,200 units under construction,” said Wood, adding the city has increased its total number of rental units by 18,000 since 2010, to 55,000.

Single-family market woes will throw some cold water on the overall industry as Wood said three of Utah’s top homebuilders “overbuilt” and are “pulling back” in 2023 in an effort to liquidate inventory.

But unknowns remain, like the long-term effect of the government pumping $5 trillion into the economy via stimulus packages. Supply chain constraints, and how those impact schedules, delivery times, and budgets will also keep things in limbo. Then, of course, is the workforce.

Wood emphasized, “We have a skill shortage; it has driven prices up,” he said. “We haven’t had a labor shortage like this for decades.”

Factors Leading the Head/Tail Winds

Gochnour, in a meeting with members of the Associated General Contractors in November, rattled off a list of factors that determine economic headwinds and tailwinds, including inflation, interest rates, all-time high corporate profits, supply chain woes, housing volatility, and federal fiscal support programs that pumped more than trillions of dollars into the economy, forcing the Fed to raise rates, projected to hit 5.25% by March or April.

“Construction is a leading sector,” she said. “Hang on to your employees. Even if you’re seeing some headwinds, it won’t be long-lived. Find a way to get through this high inflation, high interest rate environment. Come late summer, we’ll all feel better. It’s a gutsy thing to say because it could be long.”

She continued, “One of the reasons I’m more bullish on Utah is we’re an energy state,” checking off the oil, gas, and renewable energy industries. “By and large, you’ll see our state doing more oil and gas exploration. The pressure for renewables will continue on their trajectory.” Utah has diverse options going forward including geothermal, solar, wind, coal, oil, and natural gas. “We have a strong portfolio of (energy) assets.”

Spendlove said the current economic climate and possibility of an actual recession is tough to read both nationally and locally. “Professional economists who do this every day don’t know. The difficulty in understanding the economy is unprecedented.” He pointed to the pandemic primarily and the “ripple effects” it has caused. From December 2021 to September 2022 the U.S. GDP expanded by 7%, with a growth of 2.6% from September-December.

Pressure to Expand Labor Pools

“Workforce development is number one in our mind,” said Troy Thompson, AGC of Utah Chair, at the opening session of the AGC of Utah’s 101st Convention on January 20, listing primary goals for the year. “We’re down 1.5 million construction workers prior to the big recession and we’ve never made that up. Training for craft people is [critical] We’re committed as a board and staff on workforce services.” Specific items include workforce development, education and training, apprenticeship/craft training, advocacy and government relations, and networking activities.

Representatives from the Utah Department of Workforce Services ran a breakout session during AGC’s convention, highlighting its program and overall clout, with a staff of 2,100 people committed to hiring people across the state, including rural communities. Getting prospective employees into a construction apprenticeship program is vital to securing committed, long-term workers.

Melisa Stark, Commissioner of Apprenticeship for DWS, said “With apprenticeships, it’s a strategy for recruitment for current employees. If you invest in employees, they will invest in you,” she said. “It affects compensation, culture, [and] retention. 93% of apprentices remain with employers after completion of an apprenticeship program.”

Thompson added that more than 40% of the currently employed workforce is looking for opportunities beyond their present job. It’s up to individual firms to work together to get the word out that construction is a top-shelf industry with copious benefits.

“It’s hard to get good people into the construction industry,” he said. “We have a lot of work ahead of us to recruit young people. We’re proud of our workforce services and our partnership with the state. We’ve got to get into high school and junior high [schools]. We have to work together on solving this problem.”

Recession-Proof Factors

The single-family housing market is expected to soften, despite modest declines in home prices. The multi-family market remains strong, with dozens of apartment projects continuing to sprout up from Ogden to Provo. Gochnour listed several factors that keep Utah insulated from negative outside economic forces.

Utah has a demographic cushion, given it was the fastest-growing state from 2010-20. That underbelly of growth feeds all businesses in Utah’s diverse economy. According to Gochnour, Utah is one of a handful of states that has an economic structure similar to the U.S. “It makes us have less wild swings, we have industries that keep us stable,” she said, listing energy, life sciences, agriculture, warehouse/distribution, healthcare, tech, tourism.

She also highlighted that Utah’s leadership is respected, and the state is well-known outside its boundaries as one where problems are quickly solved, and trust remains high. Utah also has a peaceable election environment with a high level of trust in public institutions. “Social capital is really high,” she added. “We end up with balanced budgets, a surplus of funds, and an ability to get through economic challenges. It’s the best state to do business.”

Steve Green is out in McCornick, Utah. Where is that? And what’s near McCornick? “Nothing,” joked Green, the Sr. Vice President for Wheeler Machinery Co. While he may be far from even the smallest of small towns, with Holden and its 492 residents 13 miles away, he’s close to the site of a major development in data center technology. Isolated on the western edge of the Sevier Desert, the Joule Data Center will also be isolated from the grid—by design. Operation Gigawatt Rolls On Green is one of many energy and power professionals hoping to double Utah’s power generation capacity by 2034 as a part of Operation Gigawatt, an initiative launched by Utah Governor Spencer Cox in October 2024. Utah has long been an economic growth leader; Operation Gigawatt aims to make Utah a power player in energy development by increasing transmission capacity, increasing energy production, strengthening policy, and investing in energy innovation. While Governor Cox’s Operation Gigawatt moves forward statewide, out in McCornick, Green said, “We’re doing operation gigawatt and a half off grid.” The Joule Data Center project team will deliver “In-situ power generation”—power not connected to any electrical distribution or transmission system. It starts with Caterpillar G3520K reciprocating generator sets that produce 1.5 gigawatts of electricity. Waste heat and exhaust from the generators then move through an absorption chiller system as part of the overall systems combined cooling, heat, and power (CCHP) solution, providing much of the water required to cool the data center servers. Beyond the electric power to be generated for the Joule project, there will be 1.5 gigawatts of thermal energy and 1.1 gigawatts of available battery storage to meet the data center's peak electricity needs. Added Green, “And we’re not taxing the local utility grid.” Isolated or Community Power? The massive power capabilities delivered there are impressive, but they reveal a troubling trend in how Utah will double its power generation capabilities. Will it be from well-funded companies looking to power data centers and AI technology separate from the grid? Or will Utah fulfill the mission of Operation Gigawatt by creating power solutions accessible to all? According to Troy Thompson, Chief Operations Officer for Big-D Companies, power generation is about more than supplying data centers. “In my mind, how do we build a billion-dollar hospital downtown that needs ten megawatts of power?” he said, referencing Intermountain Health’s future downtown Salt Lake campus, “let alone the data centers, and manufacturers who we are hoping that will come here?” Ten megawatts of power may pale in comparison to what data centers require, but it is one of many projects seeking regulatory approval to move forward. The Utah Inland Port Authority, the Economic Development Corporation of Utah, and others continue to drive projects and jobs into Utah—data centers, too. But Thompson said he has heard from many potential clients who are hesitant to bring their energy-intensive projects to the state without firm guarantees of available power. Operation Gigawatt and state leaders have embraced an "all of the above" approach to energy sources, extending the design lifespans of coal plants, embracing new technologies and power sources, and developing new power-generating capabilities. While the industry is willing, the operating environment needs rewiring to meet state goals. Changing for 21st Century Needs “With as hot as the Utah market is,” began Eric Haslem, “there are too many obstacles for us to overcome.” The market may be ready to ramp up production, said Haslem, Chief Operating Officer for Vernal-based utility and heavy civil contractors BHI, “But the current system can’t handle it. We have this massive web of transmission and distribution infrastructure that was not designed or built for the power demands of the 21st century.” “In 1970, they didn’t know what a smartphone was,” Haslem said, “let alone AI.” Transmission projects have been developed. Rocky Mountain Power/PacifiCorp’s Energy Gateway South transmission line—a 416-mile, high-voltage 500-kilovolt transmission line that runs from Mona to Medicine Bow, Wyoming—certainly helped when it went live in 2024. Still, it's just one project amidst a plethora of needs. Haslem stated that Utah's growth over the last 10 years meant a large majority of the transmission line's capacity was accounted for when it went live. .

And the King shall answer and say unto them, "Verily I say unto you, inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me."—KJV Matthew 25:40 From a social and community impact standpoint, few projects match the value to disabled and special needs individuals as the new Utah State Development Center (USDC) Comprehensive Therapies Building in American Fork. The $36 million, 65,000-SF facility was designed as a "one-stop shop," said Joe Jacoby, President of Salt Lake-based Jacoby Architects, whose team led the project’s design. It consolidates and modernizes myriad services under one roof, including physical therapy, occupational therapy, recreational therapy, speech, language, and hearing resources, and behavioral health resources. In addition, the new building offers full-service medical and dental clinics, an indoor therapy pool, an Autism treatment wing, and workshops for life skills and vocational training—all geared to helping people live independent, authentic lives, while striving to reach their full potential. "This building was very much about accessibility," Jacoby said, "and putting in many different types of resources for these residents—all in one building." Jacoby's firm has significant recent experience in projects that combine education and healthcare for people with special needs. The firm's design of the Sorenson Legacy Foundation Center for Clinical Excellence in Utah State University's College of Education and Human Services earned UC+D's 2016 Most Outstanding K-12 Project. Two years later, the firm earned another UC+D award for the C. Mark Openshaw Education Center for the Utah Schools for the Deaf and the Blind, a project similar to this one in that it contains an array of services, including education and therapy for varying levels of sensory, behavioral, physical, and cognitive abilities. "We've been working on different [design] aspects for many years, starting with a deaf preschool, which led to working with the Utah Schools for the Deaf and the Blind," said Jacoby. "With that came many other sub-specialties, like therapy for behavioral issues, cognitive issues, development disabilities, and even speech, language and hearing clinics. It helps people with a variety of disabilities and serves an underserved population of people."

On a fall tour of Utah State University's (USU) Carolyn & Kem Gardner Learning & Leadership Building (Gardner Building), students and faculty are hard at work on a late Tuesday afternoon. Getting here, where USU's business school students could thrive, was a long time coming. The University commissioned the Gardner Building to meet a new mission for the school outside the traditional knowledge acquisition and transfer for which USU has excelled since its founding in 1888: Giving students a differentiated experience they cannot get anywhere else. Purpose Revealed Frank Caliendo, Senior Associate Dean of the Huntsman School of Business, said that the new building is the third and final piece of the business complex, "a realization of the longtime vision of Dean Douglas Anderson, the driving force behind the school's transformation, to meet the needs of students for generations to come." Caliendo, a longtime Aggie (USU BS, '98; PhD, '03), said that, even after the opening of the George S. Eccles Business Building and its faculty offices and classrooms in 1970, growth in business courses eventually outpaced the school's capacity. Jon M. Huntsman Hall's 2016 opening broke the campus bottleneck, with classrooms and other spaces dedicated to business school participants. "But we still needed space for our centers and experiential learning programs," Caliendo said, of the importance of collaborative spaces and differentiated experience for the five programs (see page XX) that would call the Gardner Building home. The design intent for this final piece wasn't a re-creation of Huntsman Hall, Caliendo said of the initial message to MHTN Architects, "But it does need to rhyme with Huntsman Hall." Working within a Busy Environment The first order of business was siting the building just east of the other two business school structures. Stan Burke, Project Manager for Jacobsen Construction, said the Gardner Building was part of a trio of projects that included Ridge Point Hall and a parking garage—three Jacobsen-led projects that utilized the same construction corridor as construction commenced from "An active campus is difficult enough," said Burke of the challenges of simultaneous construction, which required constant coordination amongst the three teams, made a tad easier as they shared a job trailer. "We had to stay cognizant of the school's activities and coordinate with them so that everyone was aware of what we were doing." Coordination went from important to critical, with the three teams meeting daily to discuss coordination and scheduling material and equipment deliveries in 15-minute intervals as the respective construction teams worked on each of the three structures.

Warren and Jennie Lloyd (above) have built Salt Lake-based Lloyd Architects into a well-rounded, versatile firm capable of excelling in both the commercial and custom residential markets, as evidenced by projects such as Snuck Farm in Pleasant Grove (main photo) and this cozy private Powder Mountain based cabin in Eden (below ).

The last five years have been a whirlwind for the Larry H. Miller Company (LHM), with the organization selling the majority of its beloved Utah Jazz franchise in October 2020 for a reported $1.66 billion, followed by the sale of its auto dealership empire of more than 70 properties for a reported $3.2 billion a year later. The influx of nearly $5 billion was parlayed into several jaw-dropping real estate and other corporate purchases, including: —1,300 undeveloped acres within the massive 4,100-acre Daybreak development in South Jordan in April 2021. —Advanced Health Care Corp. in January 2021, a transitional health care provider with operations in eight states (primarily in the west) and 3,500 employees. —The purchase of the majority stake in Swig, a leader in the flavored soda craze, in May 2023. — Partnering with Utah Trust Lands Administration to develop 1,200 acres in Saratoga Springs. — The acquisition of over 1,000 acres near Park City and Hideout will include multi-family units, housing, restaurants, and retail. —100+ acre mixed-use development in an area along North Temple being dubbed “The Power District”; the future home of not only Rocky Mountain Power’s new corporate campus but potentially a ballpark for a future Major League Baseball expansion team. —A reported $600 million acquisition of controlling interest in MLS team Real Salt Lake and NWSL team Utah Royals, along with associated infrastructure, including America First Field and Zions Bank Training Center. —The development of Downtown Daybreak, a 200-acre parcel that this year saw its 30-acre Phase I debut with the completion of the Salt Lake Bees' new 8,000 capacity stadium—dubbed The Ballpark at America First Square—in April, followed by a new Megaplex cinema entertainment center in July with luxury theatres, bowling, games and a scratch-made kitchen in addition to an open air plaza. A seven-story, 190-unit multi-family development is currently under construction and rising along the right field bleachers, with views that will look down into the ballpark upon completion next year. And LHM is just getting started, said Brad Holmes, President of Larry H. Miller Real Estate since 2018, calling Downtown Daybreak a "new urban center that is central to where the majority of growth is occurring" and combines a "full spectrum of business and year-round entertainment, culture and connectivity, as well as a wide range of housing options." When LHM executives first conceived of a new home for the Salt Lake Bees, Holmes said they went on a "ballpark tour" of MLB and minor league stadiums, and "really fell in love with a ballpark" in Durham, North Carolina—home of the Durham Bulls—which had buildings that framed in the stadium. So, The Ballpark at America First Square has the multi-family project underway in right field, with a proposed hotel slated to begin next year in left field. "In another two seasons, you'll have this urban setting for the ballpark that frames the mountain views. [The design is] really intentional, and I think it will bring a finished edge to Downtown Daybreak," said Holmes. "It was a process trying to figure out the best location, site plan, traffic, but it's in a great spot. The goal for us was to make it feel like it fit in with the community, almost like having a baseball stadium inside of a park, with an open corridor that connects to a plaza." Holmes said the seemingly small 8,000-capacity stadium (about half the capacity of the Bees former home at Smith’s Ballpark) aligns with national trends. "It's better to play in front of a sold-out crowd than in a half-empty stadium. Some new MLB stadiums are at 30,000 [capacity]. The trend is smaller, more intimate venues with closer views of the field."

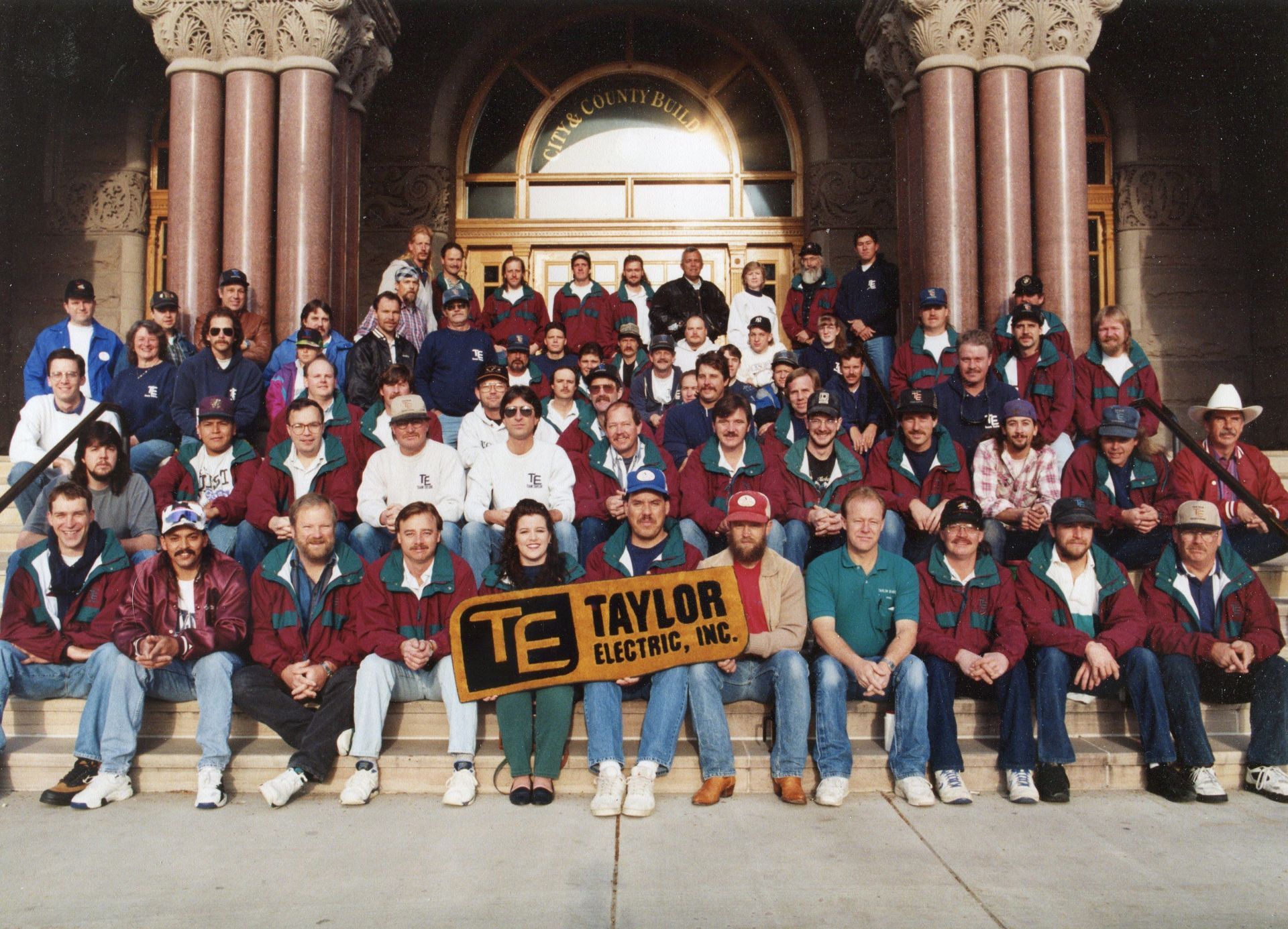

Much has changed about Hogan & Associates Construction since the company's inception 80 years ago. The name may be the most obvious example, the size of the company may be another giveaway, and the difference in markets served might require a double take if the founders could see the company today. But what hasn't changed is the firm's desire to build communities. It has regularly built important, community-focused projects with a similar purpose since the company came to life in 1945.

Imagine this: A company has just begun a meeting with the intent of moving forward with a major investment. One party knows something that will help minimize the investment's risk. Should that party tell everyone, it will save money, time, and everyone involved from future headaches. So when should that party spill the beans? At the beginning of the meeting At the end of the meeting At the right time during the meeting Never Bradley Crocker, Director of Preconstruction for Mollerup Glass, has seen how answering this question correctly—and choosing “A”—brings about successful and profitable investment in commercial construction. “I think that [project teams] need to bring in subcontractors early to help guide budgets in general,” said Crocker, detailing how every trade can bring a similar level of expertise to architects and owners by being involved from the beginning of the “meeting”, while the project is in design. Why? “We can vet cost versus performance and find the best value for the performance, which is essential as meeting or beating the budgets gets the project to construction on time,” said Ben Hiatt, Chief Estimator for Steel Encounters. After all, he said, “Nothing moves if budgets are not met.” Design-assist is a positive step forward, where subcontractors assist in matching design intent with a deep understanding of building envelopes to ensure glazing, roofing, walls, and fenestrations perform at their highest level. Glenn Rainey, Salt Lake City Branch Manager, and Larry Luque, Senior Estimator and Business Developer for Flynn Companies, each said efforts in design-assist fulfill what owners and architects want: buildings that meet the design intent and perform at their highest level for as long as possible. It’s not just architects who benefit from that early involvement. “More GCs realize they need us right up front,” said Luque. With teams whose combined experience totals thousands of hours, building envelope contractors stay up to date on changing codes, materials, and specifications, which is highly beneficial to the project. Their close involvement with vendors can help ensure a variety of solutions that meet each job’s needs and help optimize building envelope performance. Consultant Involvement Other parties are lending their expertise. Brandt Strong said building envelope quality has increased with the arrival of more building envelope consultants in Utah and a greater dedication to the building envelope in general. “We had a time where we could say ‘This is a Vegas project, and we have to have the belt and suspenders,’” said Strong, Director of Operations for Mollerup Glass. On Utah projects, the building envelope used to be an afterthought. But it’s changed for the better over the years. “The Utah teams are as sophisticated as anywhere else.” While the markups on shop drawings can draw some ire, both mentioned how working with consultants has led to better, more efficient projects, potentially reducing the need for future repairs by inspecting every material and transition on the building envelope. Said Crocker, “We cannot discredit the envelope consultants’ role in making us, and the industry as a whole, perform at a higher level.” Hiatt credited each party overseeing the building envelope scope for learning and adapting to create a better building environment, specifically in understanding seismic drift and its relationship to glazing, as well as thermal performance and continuity. Improvements to air-barrier coordination and tie-ins to stop water and air leaks are helping buildings operate at peak efficiency. “The architects, general contractors, consultants, and trades have improved their knowledge over the years,” said Hiatt. “Design and execution of façades are better coordinated and executed.”

By Bradley Fullmer It's been a whirlwind 18 months for Adam Del Toro and Nick Pexton, who co-founded Fountain Green-based Reliance Engineering Services in May 2024, a company specializing in full-service telecommunications engineering, including design, project management, permitting, and funding and grant applications. Two years ago, Del Toro was more than a decade into his career as a Research & Development Supervisor for natural gas giant Dominion Energy, while Pexton was working for Nephi-based Rocky Mountain West Telcom (RMWT) as a Sr. Director of Business Development, with just over four years at the company. The two had met a couple of years earlier while collaborating on a potential fiber optic network project in Mona that never happened. Neither was particularly content with their respective positions, so when Del Toro got a random call from Pexton in March 2024, the timing could not have been better. "I was planning on leaving the natural gas industry and start my own firm [...] Nick happened to call the day I was putting in my two weeks [at Dominion],” said Del Toro, 39. "It definitely felt like Providence was helping us." "Somebody was looking after us, because the timing was unbelievable," added Pexton, 35. "It's crazy how things lined up." Del Toro is a native of St. George and earned a Bachelor of Mechanical Engineering from Utah State University in 2011. After 2.5 years as a USU Graduate Research Assistant, he joined Dominion Energy in January 2013, where he designed major natural gas systems and structures. Del Toro also earned a Master of Clinical Mental Health Counseling from the University of the Cumberlands (Williamsburg, Kentucky) in 2023, and moonlights as a counselor at The Center for Hope in Springville, where he helps clients address life challenges both personally and professionally. Pexton is a native of Nephi and studied at Utah Valley University from 2008 to 2010, and earned the Certified Telecommunications Network Specialist designation from Teracom Training Institute (2013-2014). Pexton joined Nephi-based Mid-State Consultants, a telecommunications engineering firm, in March 2011 and spent more than nine years there. He joined RMWT in June 2020, gaining experience in project management and operations. After that fortuitous phone call from Pexton to Del Toro, the pair met four times from March to May to "make sure we were aligned on what the company would look like," Pexton said. "It was a pretty quick process," added Del Toro. "We got talking about goals, how to build a general company vision. I trusted Nick's background and experience, and his character, as well. It was a big risk, but I'm a sink-or-swim guy. If those are my options, I'm going to swim!" Since teaming up, the pair have been aggressive regarding company growth, having exploded from just the two of them to 30 employees, with revenues expected to more than quintuple from $560,000 in 2024 to nearly $3 million by the end of this year. Both expect the telecommunication market to be a fruitful, busy market given the need for fiber optics to rural America, in addition to the "Internet for All" initiative in May 2022 that was part of the National Telecommunications and Information Administration's (NTIA) implementation of the infrastructure law that allocated $65 billion to improve high-speed Internet access. Utah, specifically, received $330 million, with the goal of reaching some 40,000 unserved homes and businesses. The firm's location in Sanpete County puts them in the center of the state geographically, and they're committed to working with communities of all sizes to improve their internet capacity. In addition to Utah, Reliance is working in Michigan and Oklahoma, and Del Toro and Pexton expect to land significant future work throughout the Midwest. They want to grow intentionally while ensuring a diversity of revenue streams. "We set some early goals, and we've been able to do really well—we're on track to beat our goals," said Del Toro, crediting the many employees who have joined the firm. "Those individuals took great risks coming on board. We anticipate we'll be even larger next year with the work coming down the pipeline." "Our outlook has been wise," said Pexton. "We've taken into consideration diversification into other sectors—that's a key element. Adam has experience in the natural gas industry, and we want to further our diversification and get into the power side of the industry." Major clients include the federal government (USDA), utility companies, and municipalities, with a focus on rural communities. "We love Sanpete County," said Del Toro. "We value helping the communities we live and work in and providing services that help build up the community and hopefully help the residents." "We depend on repeat work from 18 major clients, and continuously getting work from them," said Pexton. "The minute we stop doing a good job, they can go someplace else. As long as we do a good job, we'll keep getting work." The pair expect Reliance to maintain its explosive growth, perhaps even doubling its employee total in another 12 months. "Next year's [revenue] goal is $4.8 million," said Pexton. "We have confidence in what our workload will be like. We are scaling quite dramatically and want to grow at a healthy pace, where we're not stringing ourselves out too thin. We're in a good position right now."